Customer Reconciliation and 4 Common Errors : Here is how to Identify and Resolve Them

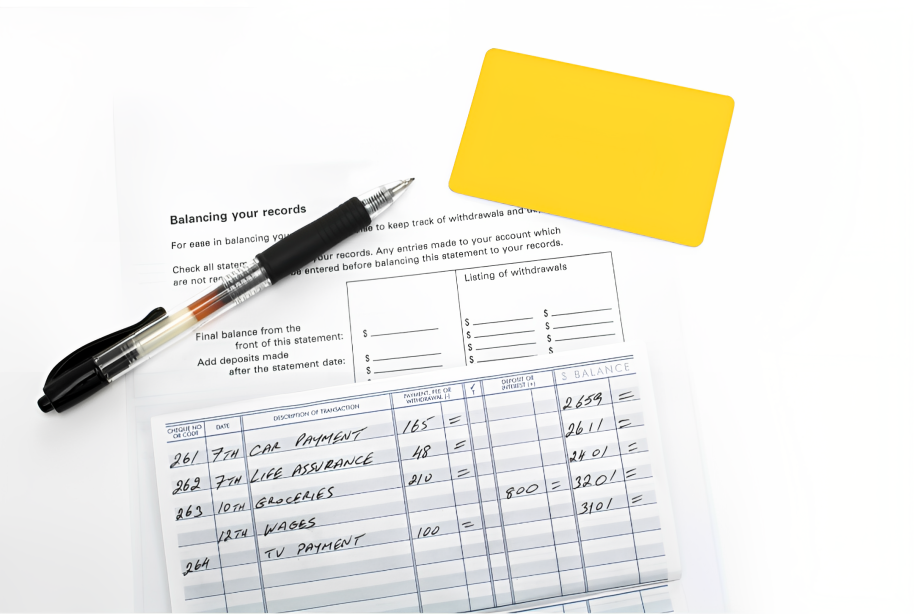

Customer reconciliation is a crucial process for businesses to ensure accurate financial records and maintain strong customer relationships. However, several errors can occur during this process, leading to discrepancies between customer and company records. In this blog post, we will discuss four common errors found during customer reconciliation and provide insights on how to identify and resolve them effectively.

-

Incorrect Payment Allocation

One of the primary errors in customer reconciliation is the incorrect allocation of payments. This occurs when the customer’s payment is recorded inaccurately, resulting in a mismatch between the amount received and the amount applied to the customer’s account. To identify this error, compare the payment receipts with the recorded amounts and cross-check them against the customer’s outstanding balance. If discrepancies are found, investigate the payment allocation process to identify any potential issues or data entry errors. Resolving this error involves correcting the payment allocation and updating the customer’s account accordingly.

-

Unrecorded Payments

Unrecorded payments pose a significant challenge in customer reconciliation. Customers may make payments that are not properly recorded in the company’s books, leading to an imbalance between the customer’s records and the company’s records. To detect unrecorded payments, regularly reconcile bank statements with the company’s accounting records. Look for any discrepancies between deposits recorded in the bank statements and payments recorded in the company’s books. If unrecorded payments are identified, investigate the reasons behind the omission, such as missed or misplaced payment receipts. It is crucial to update the company’s records to reflect accurate customer account balances and ensure all payments are accounted for.

-

Duplicate Payments

Duplicate payments occur when a customer’s payment is recorded twice, resulting in an overstatement of the customer’s account balance. This can happen due to system glitches, human errors, or miscommunication. To identify duplicate payments, closely review the payment records and look for any instances where the same payment amount is recorded more than once for a particular customer. If duplicate payments are found, rectify the error by removing the duplicate entry and adjusting the customer’s account balance accordingly. It is essential to promptly communicate with the customer about the error and issue refunds if necessary.

-

Incorrect Invoice Posting

Incorrectly posting an invoice to the wrong customer account is another common error during customer reconciliation. This error can arise from data entry mistakes, system issues, or miscommunication between departments. To catch incorrect invoice posting, regularly review customer accounts and verify the accuracy of invoices posted against the correct customer records. If a discrepancy is detected, investigate the root cause and take the necessary steps to reassign the invoice to the correct customer account. Ensure proper communication within the organization to prevent such errors in the future.

Conclusion

Customer reconciliation is a vital process to maintain accurate financial records and ensure customer satisfaction. However, errors can occur, such as incorrect payment allocation, unrecorded payments, duplicate payments, and incorrect invoice posting. By implementing robust reconciliation processes, conducting regular reviews, and fostering effective communication, businesses can identify and resolve these errors efficiently. Promptly addressing reconciliation errors helps maintain trust with customers, streamlines financial operations, and ensures accurate account balances.

Leave a Reply